How does private equity create value? Private equity firms create value in three distinct ways: multiple expansion, leverage, and operational improvements. Understanding Value Creation is paramount during Due Diligence and especially when preparing your Exit Strategy. Value is defined by customers, investors, employees, suppliers and other stakeholders. Value itself, as well as priorities for value creation, are based in the context of meaningful engagement with key stakeholders, and opportunities and addressing threats facing the organization.

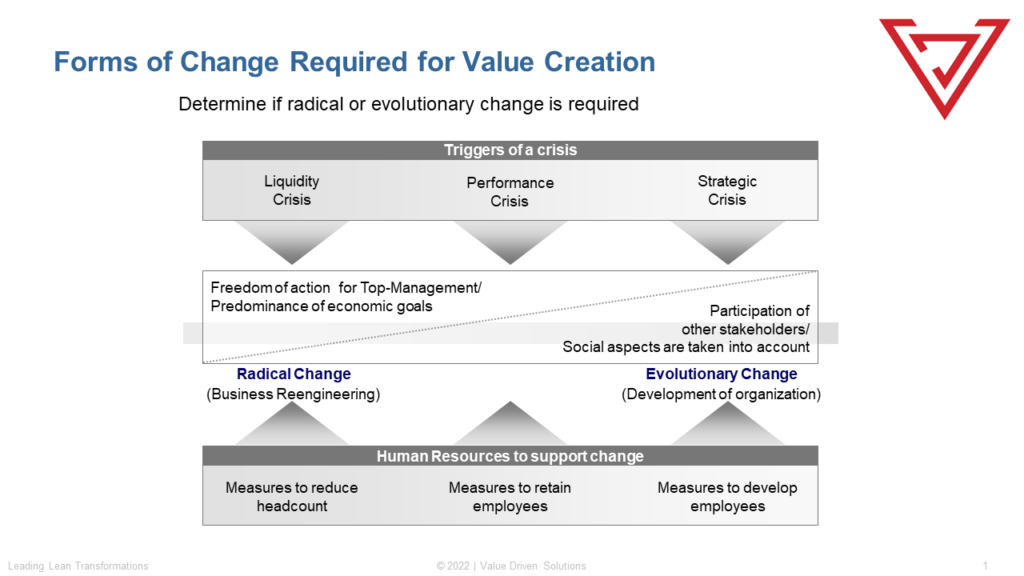

Put simply, value creation is the process of turning resources (these can be physical, such as materials, or non-physical like time) into something of perceived value. Some examples of value creation include car manufacturers building vehicles, farmers growing and harvesting crops, or banks offering mortgage loans. Different industries, businesses and markets require different forms of change (radical or evolutionary) to create value.

For private equity firms, creating value for portfolio companies is both more challenging and more crucial than ever. Financial engineering, which was once Private equity firms key strategy, is not enough in today’s competitive environment. In most industries, low-hanging investment opportunities have long been harvested, and the companies that remain require significant work to create value.

Private Equity Firms need to differentiate to win deals in this market and partnering with operating executives who have been in the seat of the founder and CEO can be an important element to setting a firm apart. Firms need to develop a system for value creation for their portfolio companies. One way to do this is by providing Value Creation Playbooks. These playbooks have a systematic approach focusing on implementing a business system, similar to Toyota Production System or Danaher Business System which is critical to being an industry leader. The VDS Business System is based around five functional areas of expertise: human capital, operational excellence, front office/ transactional excellence, strategy and growth. By utilizing the VDS Business System this expertise can be created within your portfolio companies.

VDS Business System® - VDS Consulting (vdsconsultinggroup.com)

Value Creation is usually executed in the following ways:

Annual Plan Recovery

Stabilization of fiscal business performance to meet your annual operating plan objectives by eliminating operational waste and simplifying other non-value-added activities.

Strategic Performance Turnaround

Reverse downward trend by stabilizing business performance and deploying improved processes and policies with effective problem solving and performance management.

Business and Digital Transformation

Enter new markets, develop new products, provide new services and acquire new customers or add new capabilities internally using Strategy Deployment and Program Management.

Growing Customer Connections

Enhance the relationships with your customers and suppliers and internally focus on products with 80/20 simplification for focused growth.

Value Driven Solutions is the leading consulting partner to the private equity industry and its key stakeholders; with a global practice we bring the right talent to the table to get the results you desire. Our network of more than 500 experienced professionals serving private equity and institutional investor clients across the investment life cycle, from deal generation and due diligence to portfolio value creation and exit planning.

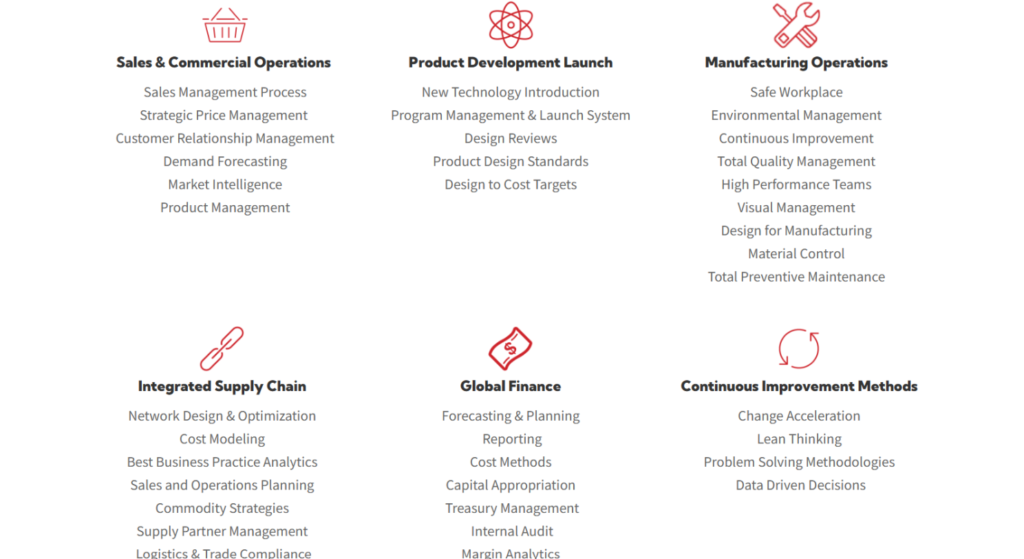

Why is the VDS Business System different? Our Enterprise Value Creation Playbooks cover every aspect your portfolio company no matter what industry. We have systems, processes, training, and strategies for your Value Creation Playbook in the following areas.